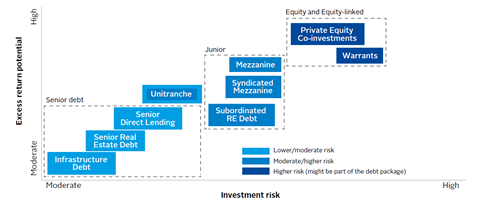

Infrastructure debt risk-return: low defaults, high recoveries and a spread pick up vs comparable corporates - Sequoia Investment Management Company Limited

Infrastructure debt risk-return: low defaults, high recoveries and a spread pick up vs comparable corporates - Sequoia Investment Management Company Limited

Primer: building a case for infrastructure finance Infrastructure debt: Ready to ride on the road to rising rates

Mint on Twitter: "#MintPrimer | Any bond purchase is done with three aspects in mind: return on investment, whether the bond has sovereign backing, and if there is a tax incentive. Read